Dear Douglas White,

Last week, the team here at MyMedicalShopper read an article published by Kaiser Health News highlighting your frustration with healthcare price transparency, or the lack thereof. We’re writing this week to tell you not to lose faith! Our platform has already helped thousands of New Hampshire residents avoid surprise medical bills, and we’re expanding into Massachusetts later this year! We just wanted to let you know that help is on the way!

Get ready,

–The MyMedicalShopper Team

You know the crazy, obscure medical billing industry that medical consumers deal with every day? Well, it came long before price transparency. And as a result, price transparency can fall short of expectations.

Douglas White’s story highlighted in the Kaiser Health News article is not uncommon:

“Douglas White knew high-deductible insurance is supposed to make patients feel the pain of medical prices and turn them into smart shoppers. So he shopped. He called around for price quotes…but the bill he got later was…more than twice as much—from a hospital he had no idea was connected to the imaging center.”

The same Kaiser article reported that nearly 1 in 3 Americans with private health insurance in the past two years had received a surprise medical bill. That’s a lot of surprises.

In fact, White, a doctor of physical therapy who likely has some medical billing knowledge himself, couldn’t even save himself from the billing abyss. If someone with insider knowledge can’t navigate the system, what hope is there for the rest of us? It’s this type of experience that discourages medical consumers from shopping for their care altogether. Who wants to go through the trouble of finding healthcare prices just to be defeated in the end?

Better yet, why is this happening so much?

The answer is that “price transparency” is a really buzzy buzz word in healthcare these days, but frankly, most price transparency tools just aren’t that transparent. And as a result, medical consumers like Douglas are constantly surprised when their medical bills arrive, even when they researched prices ahead of time.

Let’s think about it from the perspective of the insurance companies. Carriers earn higher revenues from premiums, and thus, higher profits, when they pay higher claims. When you understand this inherent conflict of interest, it starts making sense that carrier-sponsored “price transparency” is so limited. They might bury a tool somewhere on their website that allows their members to search pricing on a handful of diagnostic tests and simple procedures, but they obviously don’t want to provide enough useful information to put a significant dent in our wild healthcare spending overall.

Insurance carriers often claim that they support price transparency, but they hide behind thinly veiled excuses that their negotiated reimbursement rates with providers are “confidential” or “proprietary,” and that healthcare billing is too complicated for patients to understand. But should reimbursement rates really be kept confidential from the members who are paying for premiums? And would it really be too difficult for Douglas White to understand a list of associated procedures that are billed alongside the CT scan his doctor ordered?

Price transparency doesn’t have to be this way. The information isn’t too complicated. It’s simply not given to us! Our broken healthcare system might not work for consumers, but it’s been working extremely well for insurance carriers and overpriced providers. And it’s because it’s in their best interest to keep us clueless! The less we know, the more they gain financially.

And while price transparency tools are popping up all over the country, most of them aren’t cutting it for medical consumers. Who wants to go through a list of providers in their area and call around to find prices for a procedure, write down the information, and then compare it all? Better yet, who has time? Or how useful is it to browse prices on a couple dozen tests and procedures when there are over 9,000 different codes used in our healthcare system?

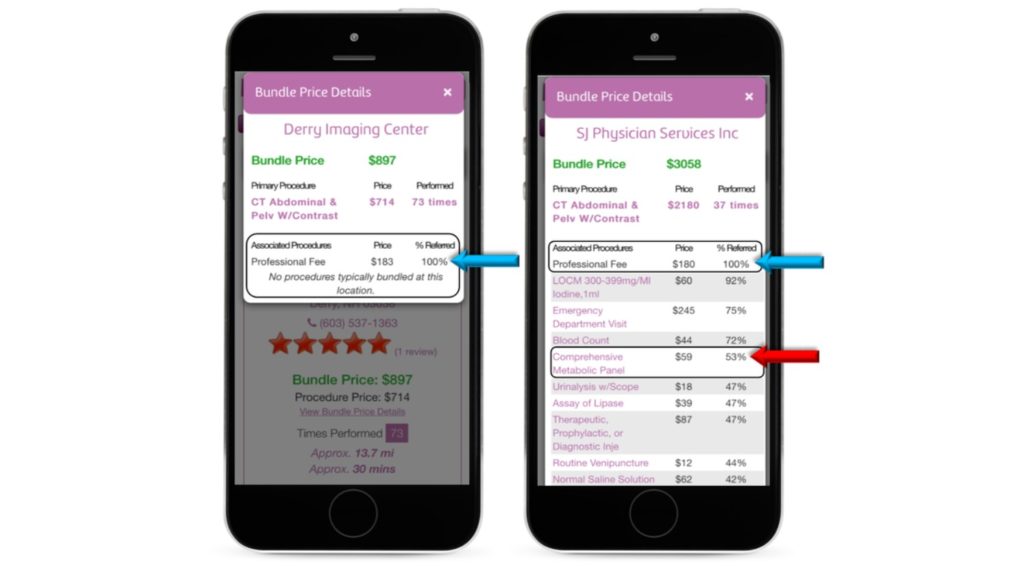

Given the resources that Douglas White had available to compare prices, a surprise medical bill is no surprise at all. It’s likely that when White asked his insurer, Harvard Pilgrim, how much the CT scan would cost at Coolidge Corner Imaging, he got exactly what he asked for—the procedure price—instead of how much the CT scan would cost including any associated procedures and fees. Most medical consumers don’t know enough about the billing process to know that they should ask about associated procedures and fees when shopping for their healthcare. And most of us might assume that our insurer would be helpful and knowledgeable enough to relay this information to us anyway. But most insurance carriers, providers, and even independent price transparency tools don’t even know how to include pricing for associated procedures, which often varies greatly from provider to provider. This is one reason why medical consumers are continuously surprised by medical bills.

You may be thinking at this point, “Isn’t there a time-efficient way to shop for healthcare based on price, quality, and convenience that will also help me avoid surprise medical bills?”

There is.

We saw too many people like Douglas White, trying to take control of their physical and financial health, then falling short, because the system is designed to benefit those at the top—insurance carriers and overpriced providers.

For too long medical consumers have been cast aside, while insurance companies and hospitals have been focused on their bottom lines—not anyone’s healthcare—and certainly not anyone’s wallet.

The MyMedicalShopper platform could’ve helped Douglas avoid his surprise medical bill, because our bundle pricing feature shows associated costs and professional fees that often accompany procedures and tests (see image below). And it’s totally customized, showing users accurate summaries of our big data analytics for every procedure billed through private insurance, at every provider that performed the procedure for New Hampshire residents last year! No surprises here!

Unfortunately, MyMedicalShopper didn’t expand into Massachusetts in time to help Douglas White this time around. But later this year, we’ll be rolling out analytics from Maine and Massachusetts residents to our platform, greatly expanding the range of our service that is so badly needed by healthcare consumers. We’re working hard to give consumers all the information they need and deserve, so they can make intelligent healthcare decisions and eradicate medical bill surprises.

So yeah, most price transparency might fall short of your expectations right now, but hang tight—help is on the way.